Mergers and acquisitions (M&A) involving the Middle East and North Africa (MENA) reached $115.5 billion in value in the first half of 2025—a 149 percent increase compared to the same period last year, according to LSEG Deals Intelligence. This marks the highest first-half total since LSEG began tracking the data in 1980.

The number of deals announced in the region rose by 16 percent, reaching the highest level in three years, underscoring the region’s resilience amid global uncertainty, including the impact of the Trump tariffs.

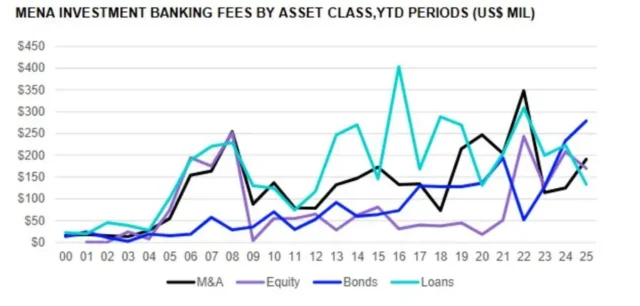

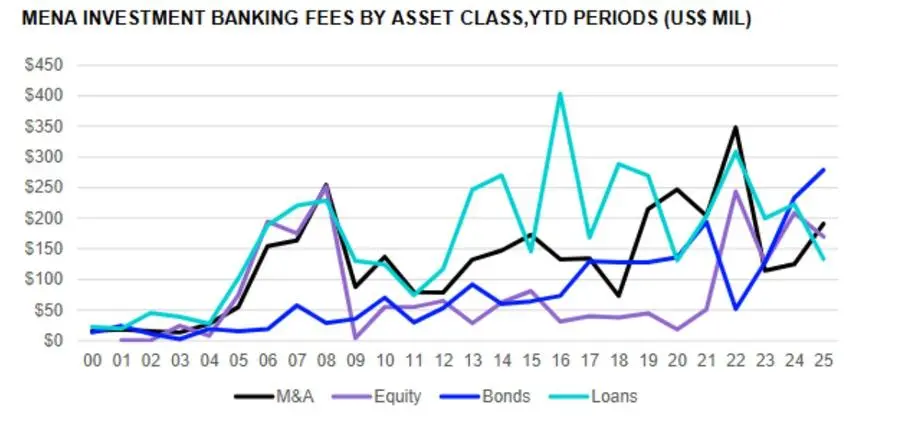

Equity capital markets were the most impacted, with underwriting fees declining 18% to $169.9 million, marking a two-year low, according to LSEG’s ‘MENA Investment Banking Review H1 2025’ data

An estimated $773.7 million in investment banking fees were generated in MENA over the period, down from $790.28 million in H1 2024, with HSBC Holdings taking the top spot with $64 million in H1 fees or a 6% year-on-year increase.

JP Morgan took second place, with $56 million in banking fees, signifying a 65% year-on-year increase, followed by Citi coming in third, generating $50.8 million in fees and a 55% increase over H1 2024.

Rise in issuance

The LSEG report also revealed a 20% rise in debt capital markets’ underwriting fees to $278.9 million in the first half of 2025, hitting an all-time high.

The MENA region saw a record surge in bond issuances, totalling $86.8 billion during the first half of 2025, and indicating a 17% rise in value over last year, besting all previous first half tallies.

Advisory fees earned from completed mergers and acquisitions (M&A) transactions totalled $191 million, 52% more than the value registered last year at this time and the highest first-half total since 2022, LSEG data revealed, which was buoyed by robust dealmaking in MENA.

The largest completed deal in the region involved Scopely, a US-based firm backed by Saudi Arabia’s Public Investment Fund, which signed a deal worth $3.5 billion to acquire the video game division of Niantic Labs.

In the region, Saudi edged out the UAE once again regionally, accounting for 41% of all MENA fees generated during the first half of 2025, followed by the UAE at 35% and Qatar at 7%.

According to LSEG, syndicated lending fees declined 40% compared to year ago levels to US$133.9 million, hitting a five-year low.

LSEG Investment Banking fees are imputed for all deals without publicly disclosed fee information.